south carolina inheritance tax 2019

South Carolina also has no gift tax. Eight states and the District of Columbia are next with a top rate of 16 percent.

INCREASE IN SOUTH CAROLINA DEPENDENT EXEMPTION line w of the SC1040 The South Carolina dependent exemption amount for 2019 is 4190 and is allowed for each eligible dependent including both qualifying children and qualifying relatives.

. Personal income tax. Make sure to check local laws if youre inheriting something from someone who lives out of state. You can do that by designating donations on Schedule I-330 contributions for check-offs in your South Carolina individual income tax return.

The values of these deductions for tax year 2018 are as follows. This effectively reduces the state tax on capital gains from seven percent to 392 percent. However the Palmetto States income tax is between 0 and 7 the 13th-highest in.

South Carolina does not levy an estate or inheritance tax. No estate tax or inheritance tax. Has the highest exemption level at 568 million.

It is one of the 38 states that does not have either inheritance or estate tax. Unique to South Carolina is a 44 exclusion or subtraction from the capital gains. No inheritance tax in South Carolina.

It is one of the 38. Currently state tax liens are filed with the office of a countys Register of Deeds Register of Mesne Conveyance or Clerk of Court. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state.

Importantly however while SCDOR has announced an extension for the filing of 2019 South Carolina income tax returns and the related payment of 2019 income taxes to July 15 2020 SCDORs prior guidance concerning taxes other than income taxes and quarterly estimated payments due April 15 2020 remains in effect. However the federal government still collects these taxes and you must pay them if you are liable. Estate taxes generally apply only to wealthy estates while inheritance taxes.

On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025. There are no inheritance or estate taxes in South Carolina. For instance if Mom and Dad die with 3000000 in their estate but they have three children who each inherit 13 of that estate 1000000 then each of the children may pay an inheritance tax on the 1000000 received if they live in a state which has an inheritance tax.

Does South Carolina Have an Inheritance Tax or Estate Tax. No estate tax or inheritance tax. Currently South Carolina does not impose an estate tax but other states do.

Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing and indexing system of liens imposed by the South Carolina Department of Revenue that will take effect on July 1 2019. Does South Carolina Have an Inheritance Tax or Estate Tax. Massachusetts has the lowest exemption level at 1 million and DC.

There is no inheritance tax in South Carolina. The South Carolina State Park Service hopes you will remember your state parks at tax time. South Carolina collects taxes from its residents at the following rates over 6 income brackets.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. South Carolinas property taxes are among the lowest in the country. The top estate tax rate is 16 percent exemption threshold.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. Youll see this change in South Carolina sales tax Reports for periods starting in February 2019 and moving forward according to each marketplaces effective date. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

No estate tax or inheritance tax. There is no tax assessed on the first 2970 of. There are no inheritance or estate taxes in South Carolina.

South Carolina has no estate tax for decedents dying on or after January 1 2005. Your TaxJar Report for South Carolina has been updated to reflect the sales that had tax collected and remitted by these supported marketplace facilitators. An inheritance tax is a tax based on what a beneficiary actually receives from an estate.

South Carolina Property Tax Rates for 2019 Abbeville Millage Rates Municipal Millage Rate Abbeville10652 Calhoun Falls14500 Calhoun Falls GOB 201600450 Donalds02000 Honea Path12150 Ware Shoals09600. No estate tax or inheritance tax. The average effective property tax rate is just 057 according to.

South Carolina Inheritance Tax and Gift Tax. You should also keep in mind that some of your property wont technically be a part of your estate. The federal gift tax.

For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state. The IRS then revised this guidance and announced that both the 2019 filing and payment dates were extended to July 15 2020. South Carolina imposes income taxes on income earned during the course of estate administration and there may be income andor estate or death taxes imposed by other states or nations.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. SCDOR has now issued updated guidance as well through SC Information.

Of the six states with inheritance taxes.

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Income Tax Brackets 2020

South Carolina Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

These 7 States Don T Make Residents Pay Income Taxes Capital Gains Tax Filing Taxes Estate Tax

South Carolina Estate Tax Everything You Need To Know Smartasset

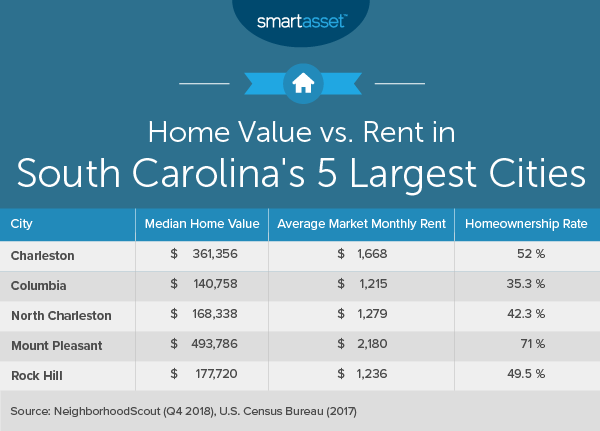

Cost Of Living In South Carolina Smartasset

South Carolina Retirement Taxes And Economic Factors To Consider

Cost Of Living In South Carolina

1728 Bee Balm Rd Johns Island Sc 29455 Mls 19007511 Zillow Real Estate House Styles Mansions

Economy Of South Carolina Wikipedia

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas